Yes, in some cases, you will need to list your assets and property on Form I-134. Let’s find out when you should do this.

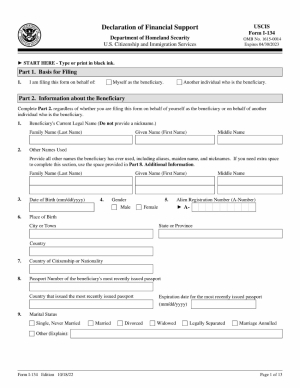

Form I-134 is a document that you may need to fill out if you want to support a non-immigrant visitor to the US with your own finances. The purpose of this form is to show that you have enough money to cover the expenses of the person you are sponsoring during their stay in the United States.

If your income exceeds 100% of poverty guidelines set by the government for your household size, you won’t have to list your assets on the form. This means that your income is enough to satisfy the requirement, and you do not need to provide any additional information about your assets.

However, if your income is not enough to meet the requirement, you must list your assets on the form to show that you have enough resources to support the visitor.

Listing your assets on Form I-134 can also increase your odds of qualifying for a declaration if USCIS comes to a conclusion that your salary isn't sufficient enough or if it narrowly meets the minimum income requirement. In this case, you need to provide details about your assets as well as property that you can sell.

Our immigration company is always happy to assist you with checking whether you qualify for the supporter in accordance with Form I-134. All you need to do is to provide us with quick answers to easy questions in our online form. With our step-by-step guide, you’ll be able to figure out your current qualifications and requirements before you pay for the service.

If you are eligible, you can choose to proceed with the service. Don't worry. The fee is reasonable. You'll obtain clear, detailed, and easy-to-follow instructions on how to fill out the form. You'll also get the I-134 declaration form that you can print out.

Types of Assets and Property That You Can Use to Support Your Declaration

What assets and property can you list to support your declaration? The biggest priority is typically to cash stored in bank accounts and investments. List the funds that you've got in your bank and checking accounts. Include deposit certificates if you have them. You may also want to list your personal property. Mention jewelry, cars as well as appliances.

The Amount of Net Assets You Need to Show on Form I-134

It's important to be aware of the assets' cash value required on Form I-134. If you plan to use assets and property to cover a shortfall, you need to know one important thing. The total net value of all your assets should be at least 5 times more than the difference between your income and the 100% federal poverty guideline for your household size.

For example, if your income is $25,000, but the necessary minimum income for your household size is $35,000, the shortfall is $10,000. Therefore, you would need to have net assets worth at least $50,000 (5 times the shortfall) to use assets to show that you can support the visitor.

If your income won’t allow you to qualify, it's usually best to choose another supporter who can do this instead of you. Using assets to qualify can be risky, and it's best to work with a professional immigration attorney if you choose to do so. That’s where our online immigration services may come in handy. We can help you determine if you qualify as a Form I-134 supporter and provide step-by-step guidance to complete the form.

Last Updated 02/26/23 05:08:51AM

Form I-134 | Affidavit of Support

Form I-134 | Affidavit of Support