While many would love to settle in the United States permanently, this might be challenging. Those who want to immigrate and become permanent residents must provide a lot of papers. This includes submitting an I-864 form or the Affidavit of Support.

Generally, the I-864 is when a sponsor enters a contract with the US government to help the immigrant financially for a certain amount of time. But, after a while, many sponsors wonder, "When will this responsibility end?" What follows are explanations of the most frequently asked questions about this topic.

How Long is the I-864 Valid?

Even by many immigration attorneys, it's known to be amongst the most perplexing immigration documents. It's a lot like filling out the immigration form while completing your tax return in terms of difficulty. In fact, that's basically it. So obviously, a lot is at risk.

This legal agreement acknowledges your willingness to shoulder the costs of supporting a family member as they apply for permanent residency in the United States. But how long is this agreement valid? It's a question that's often overlooked, but understanding the validity period of the I-864 is vital because it determines how long the sponsor is financially responsible for the immigrant.

When you sign Form I-864, you promise to provide financial support to your sponsored family member until terminating events happen. These five events are defined by laws and regulations set by the government. If none of these situations have happened, you must fulfill your promise and provide support if your family member needs it.

So what are these five terminating instances?

- Acquiring U.S. citizenship - A sponsored immigrant's support obligation under Form I-864 ends if they become citizens of the United States. No immigrant has ever been legally required to naturalize. Many immigrants, like those from Japan, would lose their native citizenship if they became citizens of the United States. After five years as green card holders or three years married to Americans, immigrants can file an N-400 for naturalization.

- Forty quarters of employment - The Form I-864 terminates after 40 quarters, not 10 years as often believed. The Terminating Event occurs if the person works and has 40 quarters of labor, either their own or their spouse's. An individual might get a statement from the SSA to calculate their work quarters.

- Leaving the US. - After losing permanent resident status, the I-864 expires. Therefore, the immigrant must leave the US.

Here's an example of this terminating scenario. If an immigrant's spouse has been in the country for two years or less, the couple will be considered as "conditional" permanent residents. After two years of conditional residency, these individuals must petition using Form I-751. Their legal right to live in the country will be revoked if they don't. In short, the I-864 is valid if the person is in the US. If the person leaves the country, the contract will end. - After deportation, they seek permanent residency using a different I-864. This is a rare case. This Terminating Event occurs if a deported person regains residency with a new Form I-864. The most likely instance of this might be if someone facing deportation received approval for a family-based petition (Form I-130). This could lead to an immigration court adjustment of status (Form I-485). The old sponsor's responsibilities are transferred to new sponsors under the statute.

- Death - A sponsor's duty ends when an immigrant dies. In the case of a sponsor’s death, their legal responsibilities under the contract terminate as well, while their estate may still be held responsible for claims made before their passing.

What Happens if the I-864 Expires?

A sponsor's obligation under Form I-864 does not expire in any way other than the five listed Terminating Events.

Firstly, an expired I-864 may negatively impact the sponsored immigrant's ability to adjust status, extend their stay, or obtain a green card and they may face deportation. If sponsors fail to fulfill their duty, the immigrant may sue them to secure financial aid. Therefore, sponsors need to understand the requirements and limitations and keep their contact information up to date with USCIS.

If issues arise, one possible solution is to submit a new Form I-864. If the sponsor's financial status changes, they can file an amended form. If the petitioning sponsor's family income doesn't meet Form I-864's standards, a joint sponsor can help. Lastly, obtaining an I-864 waiver is also an option. If the sponsor can show that they cannot meet the I-864 form's financial requirements owing to a disability or poor income, they can do this.

How to Avoid Problems with the I-864

Submitting an incomplete or inaccurate Affidavit of Support (Form I-864) can lead to issues in the immigration process.

Some common mistakes include misstating household size, not knowing when to count a joint sponsor, and misinterpreting the predicted income question.

- Sponsors should name themselves, their spouse (if applicable), dependent children, and any other dependents indicated on their most recent tax return.

- Joint sponsors can file their own I-864 without being related to the immigrant. They should also not mix the I-864A with the I-864.

- Sponsors should estimate their current yearly income when answering the projected income question and not add any other income, such as from a spouse.

- Sponsors should estimate their pre-tax income while completing the predicted income question.

- To prevent a USCIS Request for Proof, they should attach pay stubs or an employer's letter if predicted income exceeds the prior year's.

Last Updated 03/24/23 03:13:10AM

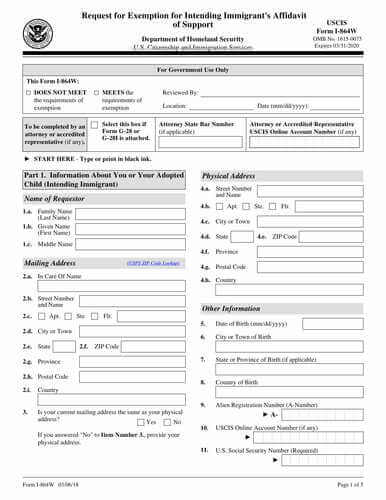

Form I-864W | Request for Exemption for Intending Immigrant's Affidavit of Support

Form I-864W | Request for Exemption for Intending Immigrant's Affidavit of Support